Changes to Contractor Pay

The 2022/23 tax year starts on April 6th and will see two significant changes to pay implemented through the National Living wage and Health & Social Care Levy – but what do these changes mean for your workers?

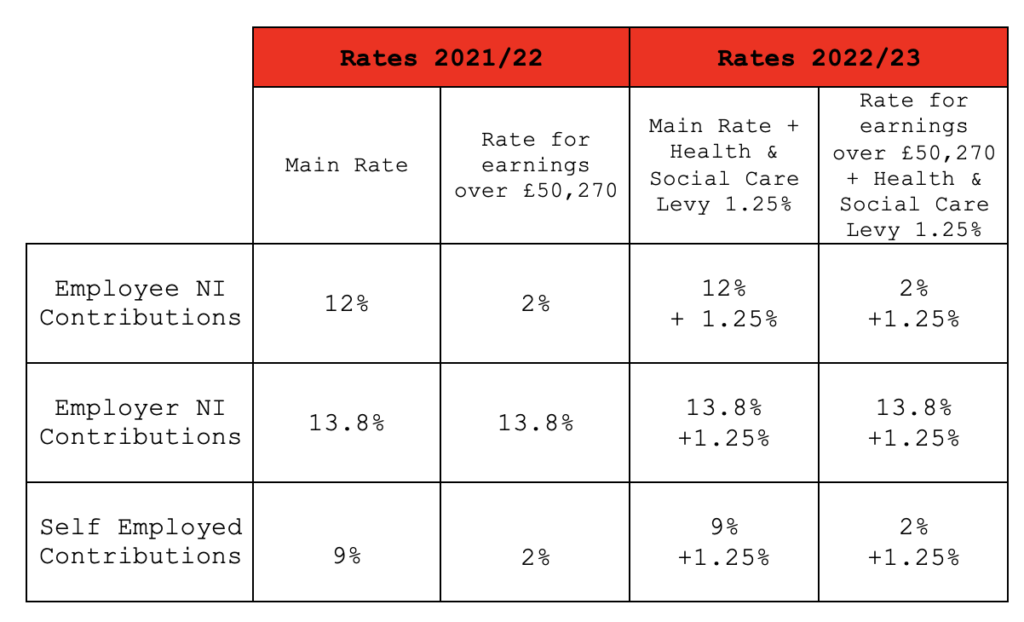

Health & Social Care Levy

This temporary increase to National Insurance will be deducted from 6th April 2022 until 5th April 2023. The contributions will help to fund the NHS and social care across the UK.

The Health & Social Care Levy will be a separate tax in its own right from Apr 2023.

Employees, employers, and the self-employed will all pay an additional 1.25% on their NI deductions.

The threshold before NI deductions will also raise on April 6th 2022, from £9,568 to £9,880.

The table below gives an overview of what this new Health & Social Care Levy uplift to National Insurance will mean for Employees and Employers.

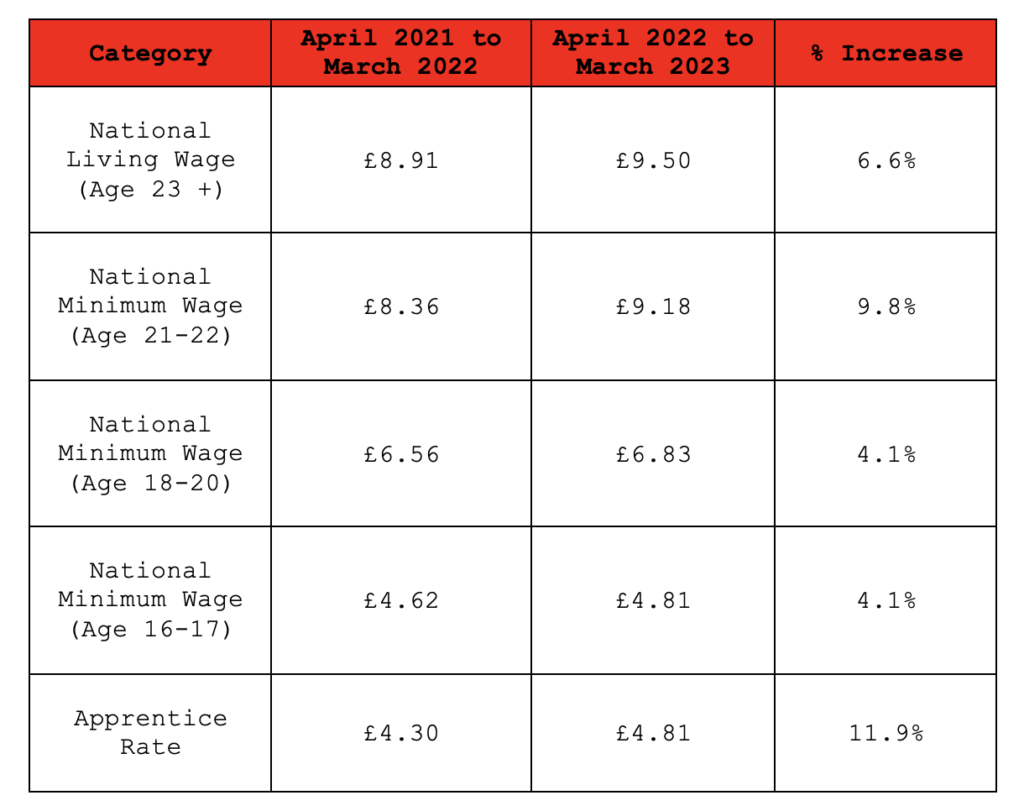

National Living and Minimum Wage increase

Alongside the Health & Social Care Levy increases to National Insurance, increases to National Living and Minimum Wage will come into effect on the 6th April 2022.

The table below shows the increase in National Living/Minimum Wage from April 2022.

Please ensure your contractors are aware of the new deductions and the National Living and Minimum wage increases.

The Red Ark Customer Service teams are always available to answer any queries your contractors may have.

If you need further support on the changes, please don’t hesitate to get in touch with us at www.red-ark.co.uk. Alternatively, head over to https://www.gov.uk/guidance/prepare-for-the-health-and-social-care-levy to find out more.