Construction Industry VAT Domestic Reverse Charge

What is the VAT Domestic Reverse Charge?

The VAT Domestic Reverse charge was first announced by HMRC in 2017, in a move to combat VAT fraud in the Construction Industry Scheme (CIS).

An example of this type of fraud is when a contractor is paid via a Limited Company and bills for VAT, but then does not fulfil their own VAT commitments. This type of fraud is widely seen and often involves inactive companies which are set up to steal VAT, whilst working alongside legitimate businesses.

It was initially due to come into play in October 2019 but was pushed back twice due to Brexit and Coronavirus. The new implementation date has been set as 1st March 2021. This will only affect businesses within the supply chain providing CIS services.

The change focuses only on Building or Construction services and will shift the responsibility for accounting for VAT on ‘specified services’ from the supplier to the recipient. The ‘specified services’ are noted in sections 5 and 6 of the Statutory Instrument for VAT Reverse Charge for Building and Construction Services. More information can be found here.

The VAT Domestic Reverse Charge will apply where:

- CIS applies, AND

- The services are not applied to a direct end user, AND

- The services are listed within the services listed in article 5 and NOT listed within article 6 of the Statutory Instrument.

Points to Note

There are a few key points to note in addition to the criteria above; the charge can only affect the specified services between VAT registered companies, and there cannot be a connection between said companies i.e., if they’re in the same commercial group. Furthermore, only standard rate or reduced rate supplies will be affected.

So, what does this mean?

This can be viewed as good news for Employment Businesses and Intermediaries alike as the latest government guidance states “employment businesses who supply staff and who are responsible for paying temporary workers they supply, are not subject to the reverse charge”. Implementation of the charge would likely have caused strain on cash flow and result in significant changes to the business in procedure. With that said, it’s still important to be aware of the upcoming changes as it may impact the supply chain in such a way that you could still be affected.

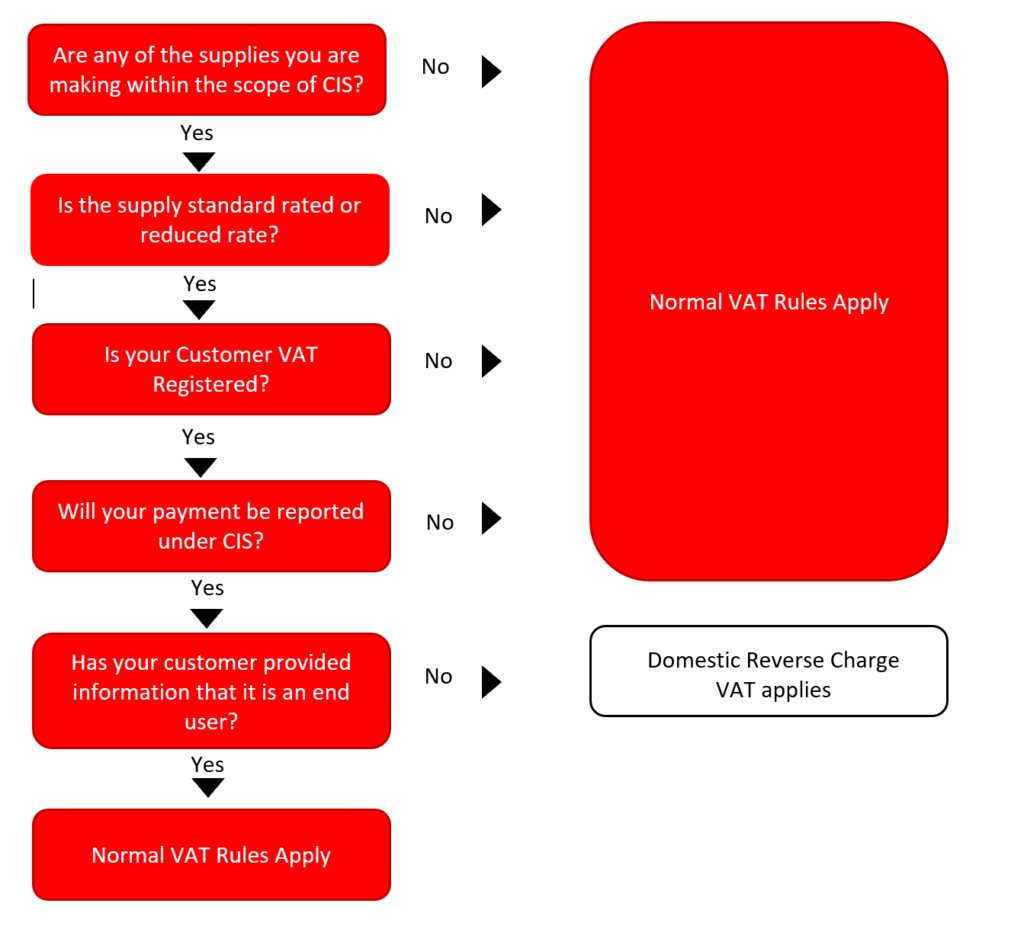

We’ve included a flowchart below, detailing how the charge will work and to help you determine whether you should apply the domestic reverse charge or not.

Want to find out more? Our friendly, knowledgeable team are on hand ready to help if you believe that the new VAT domestic reverse charge rules apply to your business. Contact us today to discuss what we can do for you.